Assessing Whether Afterpay Use Can Impact Your Credit Report Score

As the popularity of Afterpay continues to climb, lots of individuals are left wondering about the prospective impact this solution might have on their credit rating. The relationship in between Afterpay usage and credit rating is a topic of passion for those aiming to maintain or enhance their economic health and wellness. By exploring the subtleties of exactly how Afterpay purchases are seen in the eyes of debt bureaus, we can begin to decipher the complexities of this modern-day repayment approach's influence on one's creditworthiness. Allow's explore the complexities of this partnership and discover the key aspects at play.

Understanding Afterpay's Effect on Credit rating

The usage of Afterpay can affect people' credit score scores, triggering a requirement for a thorough understanding of its effect. Afterpay, a prominent "purchase now, pay later" service, allows consumers to split their purchases right into smaller installation repayments. While Afterpay does not execute credit scores checks when consumers at first sign up, late or missed out on payments can still impact credit report scores. When a client misses a payment, Afterpay may report this to credit scores bureaus, leading to a negative mark on the individual's credit rating report. It is essential for customers to recognize that while Afterpay itself does not naturally damage credit report, reckless use can have effects. Keeping an eye on settlement due dates, maintaining an excellent repayment history, and making sure all installments are paid on schedule are essential action in guarding one's credit history when utilizing Afterpay. By understanding these nuances, people can take advantage of Afterpay responsibly while minimizing any type of potential adverse impacts on their credit rating.

Elements That Impact Credit Rating Changes

Recognizing Afterpay's impact on credit ratings reveals a direct web link to the various variables that can substantially influence modifications in an individual's credit report score over time. Making use of Afterpay responsibly without maxing out the offered credit rating can aid maintain a healthy and balanced credit history utilization proportion. Additionally, new credit queries and the mix of credit accounts can influence debt scores.

Tracking Debt Score Adjustments With Afterpay

Keeping an eye on credit rating rating adjustments with Afterpay involves tracking the effect of settlement habits and credit score application on overall debt health. Utilizing Afterpay for tiny, convenient purchases and keeping credit score card balances low family member to credit rating limitations shows liable credit scores habits and can favorably affect credit rating scores. By staying proactive and watchful in keeping an eye on repayment behaviors and credit utilization, individuals can effectively manage their credit scores score while using Afterpay as a settlement alternative.

Tips to Take Care Of Afterpay Sensibly

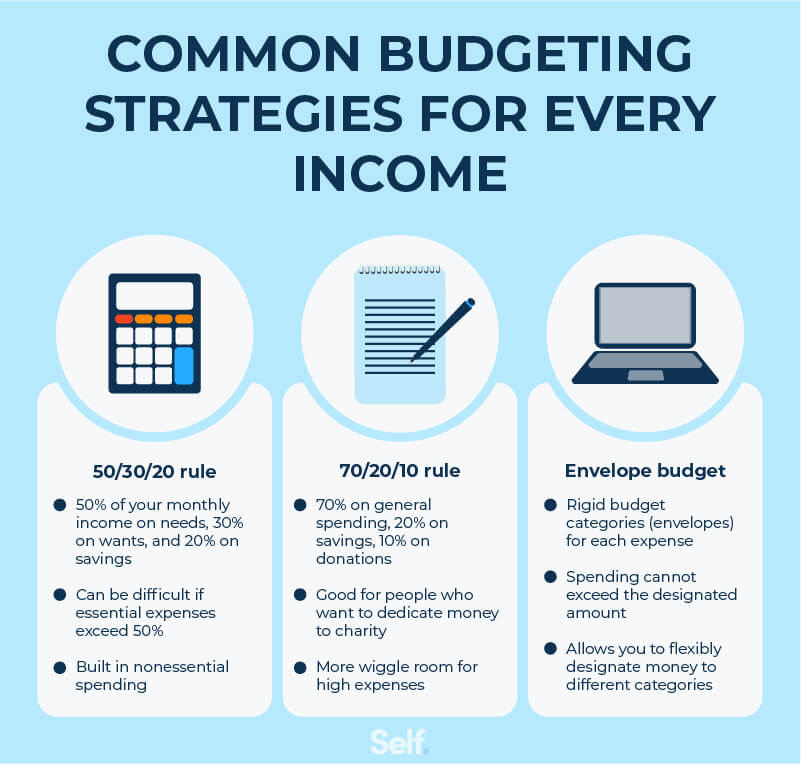

To browse Afterpay properly and preserve a healthy credit rating, individuals can implement reliable strategies to manage their economic commitments intelligently. To start with, it is vital to produce a budget plan outlining income and expenditures to make sure affordability prior to committing to Afterpay purchases. This technique helps avoid overspending and collecting financial obligation over one's head's methods. Secondly, utilizing Afterpay selectively view it now for essential things as opposed to indulgent acquisitions can help in maintaining economic stability. Prioritizing settlements for needs can hop over to these guys stop unnecessary economic stress and promote accountable spending behaviors. Furthermore, maintaining track of Afterpay payment schedules and ensuring prompt payments can aid avoid late costs and negative influences on credit history. Regularly keeping an eye on Afterpay transactions and total monetary wellness through budgeting applications or spread sheets can offer useful insights into investing patterns and aid in making educated economic choices. By following these ideas, people can take advantage of Afterpay properly while guarding their credit history and financial wellness.

Final thought: Afterpay's Duty in Credit rating Health And Wellness

In examining Afterpay's influence on credit health, it becomes apparent that prudent financial management remains critical for people using this solution. While Afterpay itself does not straight impact credit score ratings, ignoring settlements can cause late charges and financial obligation build-up, which could indirectly impact creditworthiness - does afterpay affect credit score. It is vital for Afterpay individuals to budget plan efficiently and ensure prompt settlements to maintain a positive credit history standing

Furthermore, understanding just how Afterpay incorporates with individual financing practices is essential. By making use of Afterpay sensibly, individuals can enjoy the ease of staggered repayments without jeopardizing their credit rating wellness. Keeping an eye on costs, examining cost, and staying within budget plan are essential practices to prevent monetary strain and possible credit report score effects.

Final Thought

Recognizing Afterpay's influence on credit ratings discloses a straight web link to the numerous variables that can significantly influence changes in an individual's credit rating score over time. Additionally, new credit report questions and the mix of debt accounts can influence credit scores.Checking credit rating score changes with Afterpay entails tracking the influence of settlement routines and credit score use on general credit report health and wellness - does afterpay affect credit score. Making use of Afterpay for tiny, workable purchases and keeping credit card equilibriums reduced relative to credit rating limits shows responsible credit rating actions and can favorably influence credit score scores. By remaining proactive and cautious in keeping an eye on payment behaviors and credit report usage, people can efficiently handle their credit report score while utilizing Afterpay as a payment alternative